Newsletter

Newsletter

BACK

2023

27 Feb

2023/24 Hong Kong Government Budget Highlights

The Financial Secretary Mr. Paul Chan Mo-po delivered the 2023/24 Budget speech on 22 February 2022 as summarized below:

Supporting enterprises

- Reduce profits tax for 2022/23 assessment year by 100%, subject to a HK$6,000 ceiling

- Increase tax deduction for voluntary contributions made by employers to the Mandatory Provident Fund for employees aged 65 or above from the current 100% to 200%

- Extend the application period of all guarantee products under the SME Financing Guarantee Scheme to March 2024

- Propose a "patent box" tax incentive to provide tax concessions for profits sourced in Hong Kong from qualifying patents generated through R&D

- Provide rates concession for non-domestic properties for the first two quarters of 2023/24, subject to a ceiling of HK$1,000 per quarter

- Grant 50% rental fee concession to eligible tenants of government premises and short-term tenancies and waivers for 6 months

- Further enhance the aircraft leasing preferential tax regime, which includes allowing tax deduction for the acquisition cost of aircraft and expanding the scope of leases and aircraft leasing activities qualifying for the regime

- Propose a tax deduction for the spectrum utilisation fees to be paid by the future successful bidders of radio spectrum.

- Inject $30 million into the Information Technology Development Matching Fund Scheme for Travel Agents to encourage the tourism sector to undergo upgrade and transformation

Relieving people’s hardship

- Reduce salaries tax and tax under personal assessment for 2022/23 assessment year by 100%, subject to ceiling of HK$6,000

- Increase child allowance for each child and the additional child allowance for each child born during the year of assessment from the current HK$120,000 to HK$130,000 starting from the year of assessment 2023/24

- Provide rates concession for domestic properties for the first two quarters of 2023/24, subject to a $1,000 ceiling per quarter

- Subsidy of HK$1,000 to each eligible residential electricity account

- Extra half-month allowance of standard CSSA payments, Old Age Allowance, Old Age Living Allowance or Disability Allowance. Similar arrangements will apply to Working Family Allowance

- Extend the temporary special measures of the Public Transport Fare Subsidy Scheme for six months (to October 2023)

- Issue $5,000 electronic consumption vouchers to each eligible Hong Kong permanent resident and new arrival aged 18 or above in two instalments

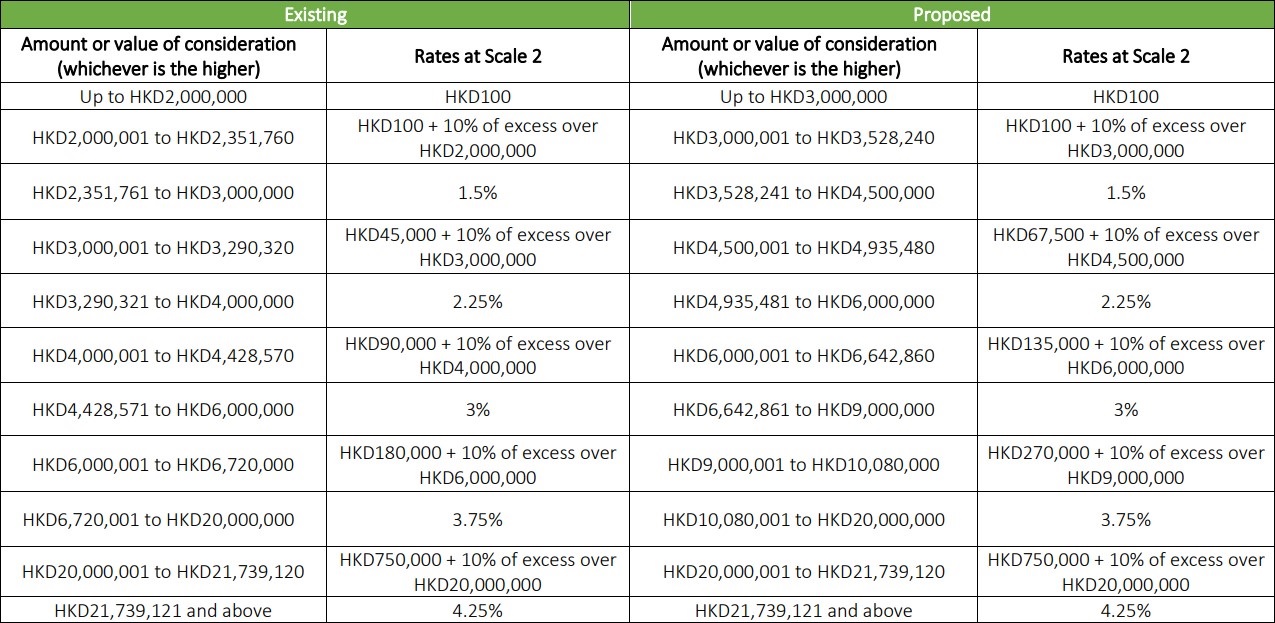

Stamp duty

- Adjust the value bands of ad valorem stamp duty on the sale, purchase, or transfer of residential and non-residential properties (Rates at Scale 2) with immediate effect. Rates at Scale 2 apply to Hong Kong permanent residents owning no other residential properties in Hong Kong at the time of acquisition (e.g., first-time buyers)

Other key proposals

- Implementation of global minimum effective tax rate (GMT) of 15% on large multinational enterprise (MNE) groups and domestic minimum top-up tax (DMTT) starting from 2025. A consultation exercise will be launched to allow MNE groups to make early preparations.

- Introduce a new Capital Investment Entrant Scheme. Applicants may reside and pursue development in Hong Kong after making investment at a certain amount in the local asset market, excluding property

- Introduce a mechanism to provide facilitation for companies domiciled overseas for re-domiciliation to Hong Kong

- Inject HK$500 million into the Dedicated Fund on Branding, Upgrading and Domestic Sales (BUD Fund) and expedite the processing of applications

- Issue no less than $50 billion of Silver Bond and $15 billion of retail green bonds in the next financial year

The budget proposals will need approval by the Legislative Council before taking effect.

For more information, please contact Ms. Amie Cheung at amie.cheung@lccpa.com.hk