The Government published legislative bill on the proposed refined foreign source income exemption regime (FSIE regime) on 28 October 2022. The Inland Revenue Department also has updated the administrative guidance on November 11, 2022. Subject to the passage of the Bill by the Legislative Council, the proposed refined FSIE regime will take effect from 1 January 2023.

Covered taxpayers

- members of multinational enterprise groups (MNE entity) carrying on a trade, profession or business in Hong Kong irrespective of the revenue or asset size.

- an multinational enterprise group (MNE group) means a group that includes at least one entity or permanent establishment that is not located or established in the jurisdiction of the ultimate parent entity whereas an MNE entity effectively means an entity whose financial results included in the consolidated financial statements of the ultimate parent entity of the collection.

- associates and joint venture entities within an MNE group, standalone local companies and purely domestic groups without any offshore operations would not be affected.

Covered income

Specified foreign-sourced income covered by the FSIE regime includes:

- interest

- dividends

- disposal gains from the sale of equity interests in an entity (disposal gains)

- intellectual property (IP) income

Note:

- interest, dividend or disposal gains (i.e. foreign sourced non-IP income) derived by regulated financial entities (e.g. banks, insurance companies and SFC licensed entities) will be excluded.

- foreign sourced non-IP income derived from or incidental to the carrying out of profit producing activities of the taxpayers as required under the respective preferential tax regimes will fall outside the scope of “specified foreign-sourced income”

Meaning of “received in Hong Kong”

A specified foreign-sourced income is deemed as received in Hong Kong when:

- the income is remitted to, or is transmitted or brought into, Hong Kong;

- the income is used to satisfy any debt incurred in respect of a trade, profession or business carried on in Hong Kong; or

- the income is used to buy movable property, and the property is brought into Hong Kong. The income is regarded as being received at the time when the moveable property is brought into Hong Kong.

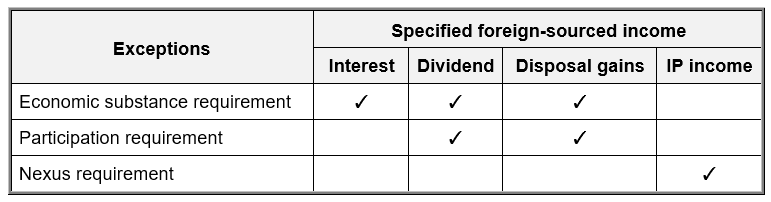

Exceptions

Specified foreign-sourced income received in Hong Kong will not be chargeable if the MNE entity meets the exception requirements specifically for the particular types of incomes as follows:

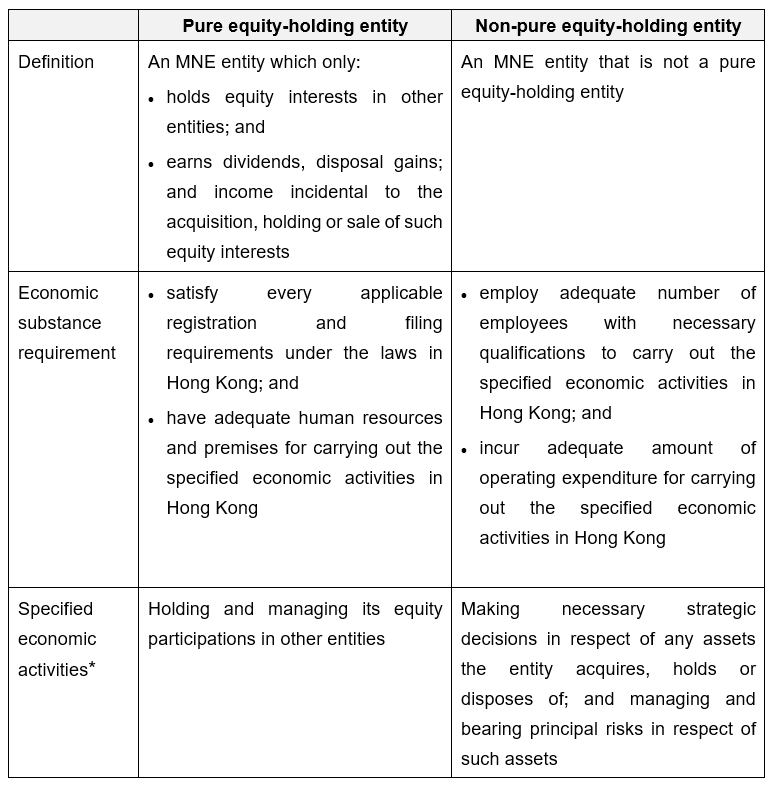

Exception 1: Economic substance requirement – for interest, dividend and disposal gains

* An MNE entity is allowed to outsource some or all of its specified economic activities provided that it is able to demonstrate adequate monitoring of the outsourced activities and that the outsourced activities are conducted in Hong Kong subject to certain requirements.

Exception 2: Participation requirement – for dividend and disposal gains

It provides an alternative to the economic substance requirement to facilitate an MNE entity which receives foreign-sourced dividend or disposal gain in Hong Kong to claim tax exemption.

Conditions apply

- the MNE entity is a Hong Kong resident person, or where it is a non-Hong Kong resident person, it has a permanent establishment in Hong Kong to which the foreign-sourced dividend or disposal gain is attributable; and

- the MNE entity has continuously held not less than 5% of equity interests in the investee entity concerned for a period of not less than 12 months immediately before the foreign-sourced dividend or disposal gain accrues.

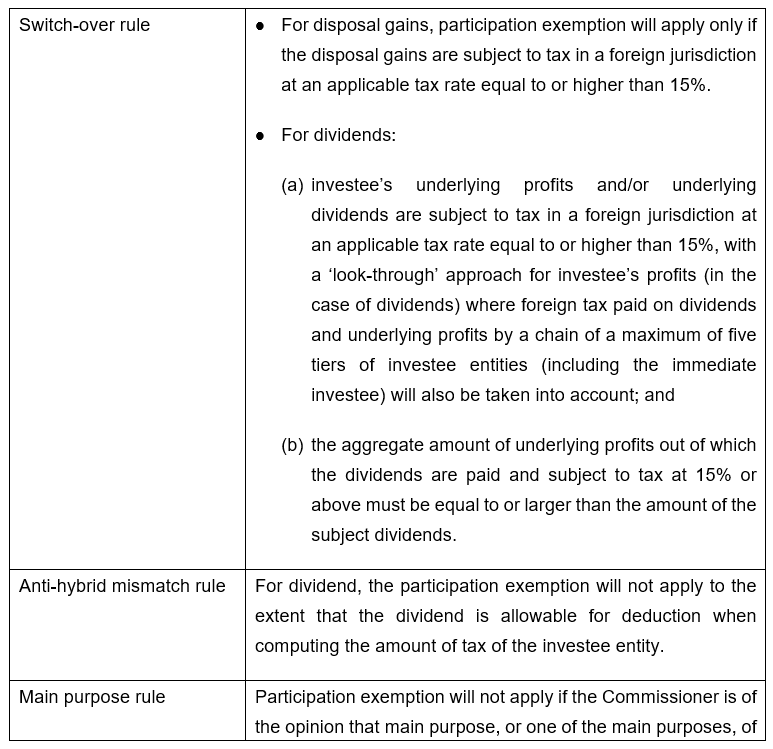

Anti-abuse rules

Following anti-abuse rules are in place to disallow the participation exemption:

Exception 3: Nexus requirement - for IP income

The tax exemption under the nexus requirement is only applicable to qualifying IP income, which means income derived from the use of, or a right to use, “qualifying intellectual property” (i.e. patent or copyright subsisting in software), but not other IP assets such as marketing-related IP assets (e.g. trademarks and copyrights).

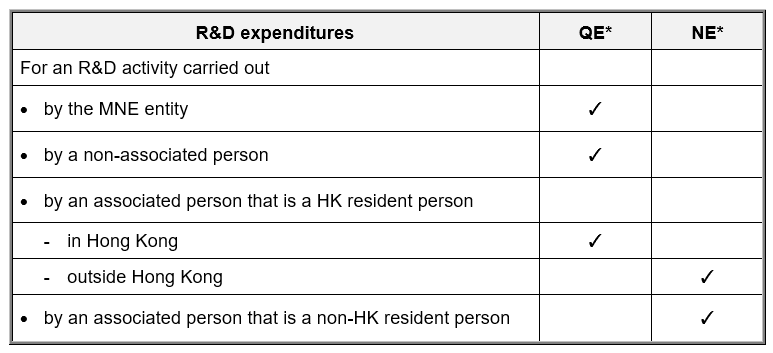

For the purpose of computing the R&D fraction (nexus ratio), an uplift of maximum of 30% of the qualifying R&D expenditure (QE) is allowed if non-qualifying expenditure (NE) has also been incurred, but the amount after the uplift (i.e. the numerator) is capped at the total amount of qualifying R&D expenditure and non-qualifying expenditure incurred (i.e. the denominator).

R&D expenditures (including capital expenditure) are classified as follows:

* QE does not include interest payments; payment for any land or buildings, or for any alteration, addition or extension to any building and acquisition of intellectual property. NE does not include interest payments and payments for any land or buildings, or for any alternation, addition or extension to any building and acquisition of intellectual property.

Only certain portion of the qualifying IP income will be exempt from profits tax.

Double Taxation Relief

Foreign tax paid by a Hong Kong resident person

Any foreign tax paid by a MNE entity who is a Hong Kong resident person on the specified foreign-sourced income that is chargeable to profits tax under the refined FSIE regime will be eligible for tax credit against the profits tax payable on the same income, either as bilateral tax credit under a CDTA or as unilateral tax credit under the refined FSIE regime.

For dividend, tax credits will be allowed in respect of not only the foreign tax paid on the dividend, but also the foreign tax paid on the investee entity’s underlying profits out of which the dividend is paid, provided that the MNE entity has held at least 10% equity interests in the investee entity when the dividend is distributed.

Foreign tax paid by a non-Hong Kong resident person

Where the MNE entity is not a Hong Kong resident person, the foreign tax paid on the specified foreign-sourced income which is chargeable to profits tax in Hong Kong may be allowed as deduction under section 16(1)(ca) of the IRO.

Taxpayers’ obligations

An MNE entity deriving chargeable specified foreign-sourced income must:

- notify the Commissioner in writing that it is chargeable to profits tax within 4 months after the end of the basis period of the year of assessment during which the income is received in Hong Kong in case no profits tax return has been issued to it for the year of assessment concerned; and

- retain records of transactions, acts, or operations relating to the specified foreign-sourced income at least until the later of the expiry of:

- 7 years after the completion of those transactions, acts or operations; or

- 7 years after the income is received, or to be regarded as received, in Hong Kong.

For more information, please contact Ms. Amie Cheung at amie.cheung@lccpa.com.hk