The Financial Secretary Mr. Paul Chan Mo-po delivered the 2024-25 Budget speech on 28 February 2024 and highlights on tax related measures are summarized below:

Stamp Duty

- Cancel Special Stamp Duty, Buyers’ Stamp Duty and New Residential Stamp Duty for residential properties with immediate effect. Any instrument executed on or after 28 February 2024 for the sale and purchase or transfer of residential properties are subject to Ad Valorem Stamp Duty at Scale 2 as follows:

|

Amount or value of the consideration |

Scale 2 Rates |

|

Up to $3,000,000 |

$100 |

|

$3,000,001 to $3,528,240 |

$100+10% of the excess over $3,000,000 |

|

$3,528,241 to $4,500,000 |

1.50% |

|

$4,500,001 to $4,935,480 |

$67,500+10% of the excess over $4,500,000 |

|

$4,935,481 to $6,000,000 |

2.25% |

|

$6,000,001 to $6,642,860 |

$135,000+10% of the excess over $6,000,000 |

|

$6,642,861 to $9,000,000 |

3.00% |

|

$9,000,001 to $10,080,000 |

$270,000+10% of the excess over $9,000,000 |

|

$10,080,001 to $20,000,000 |

3.75% |

|

$20,000,001 to $21,739,120 |

$750,000+10% of the excess over $20,000,000 |

|

$21,739,121 and above |

4.25% |

Supporting People and Enterprises

- Rates concession for domestic properties for the first quarter of 2024/25, subject to a HK$1,000 ceiling

- Rates concession for non-domestic properties for the first quarter of 2024/25, subject to a HK$1,000 ceiling

- Reduce salaries tax and tax under personal assessment for the assessment year 2023/24 by 100%, subject to a HK$3,000 ceiling

- Reduce profits tax for the assessment year 2023/24 by 100%, subject to a HK$3,000 ceiling

- Provide extra half-month allowance of standard CSSA payments, Old Age Allowance, Old Age Living Allowance or Disability Allowance. Similar arrangements for Working Family Allowance.

Assisting Small and Medium Enterprises

- Propose to introduce two enhancement measures for deduction of expenses under profits tax, will take effect from the year of assessment 2024/25:

- Profits-tax payers will be granted tax deduction for expenses incurred in reinstating the condition of the leased premises to their original condition

- Allowances for industrial buildings and structures as well as commercial buildings and structures, the time limit for claiming the allowances will be removed. This will allow the new owner to claim allowances for the property after a change of ownership, subject to factors such as the construction cost of the property and the balancing charge of its previous owner. Both enhancement measures

Other key proposals

- Introduce legislative proposal to implement “patent box” tax incentive. Profit tax rate to be reduced to 5%

- Extend the Grant Scheme for Open-ended Fund Companies and REITs for 3 years

- Enhance preferential tax regimes for family office funds, etc.

- Extend the first registration tax (FRT) concessions for electric vehicles to March 2026 with concessions reduced by 40%

- Maximum FRT concession under the “One for One Replacement” Scheme: HK$172,500

- Concession ceiling for general electric private cars: HK$58,500

- Not applicable to electric private cars valued at over $500,000 before tax

- Increase business registration fees by HK$200 to HK$2,200 per annum from 1 April 2024; business registration levy of HK$150 will be waived for 2 years

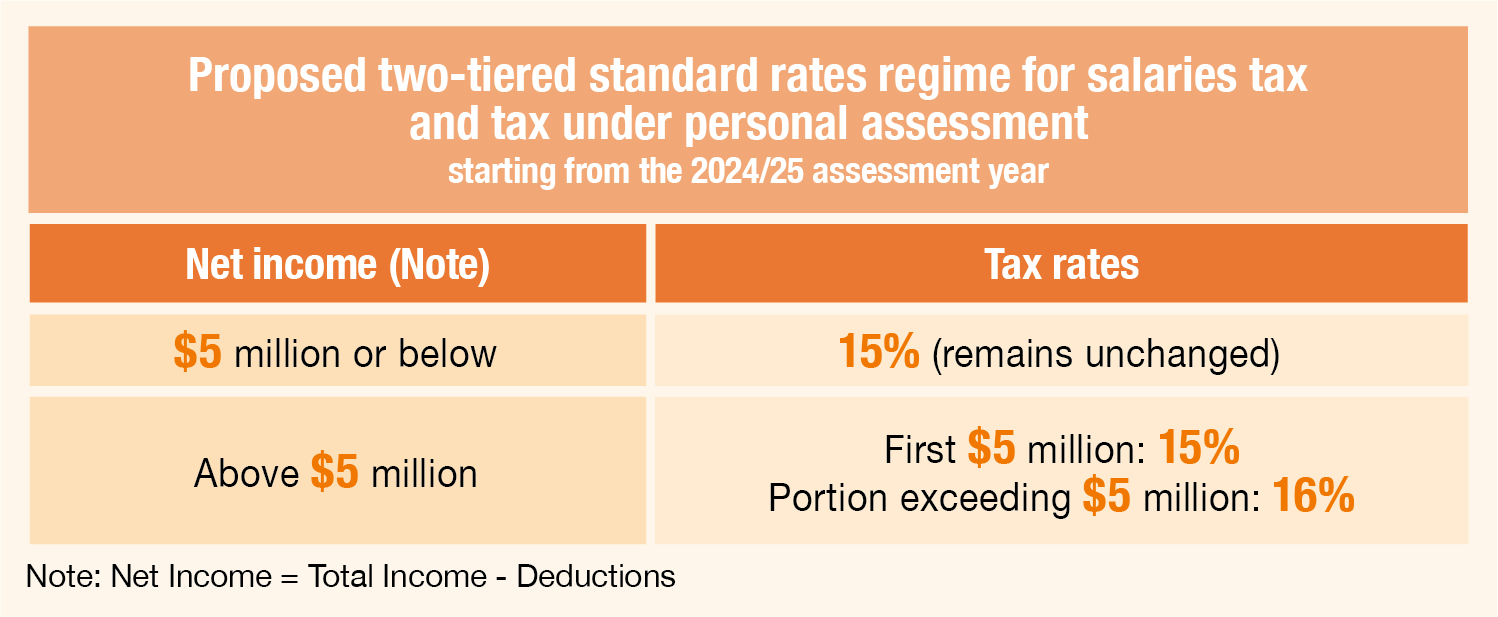

- Propose two-tier standard rates regime for salaries tax and tax under personal assessment: affecting only taxpayers with over HK$5 million net income and whose tax payable is calculated at standard rate. Taxpayers on progressive rates will not be affected

- Propose to collect hotel accommodation tax at 3% starting from 1 January 2025

The budget proposals will need approval by the Legislative Council before taking effect.

For more information, please contact Ms. Amie Cheung at amie.cheung@lccpa.com.hk