Useful

Information

Information

Hong Kong Taxation

Hong Kong is world renowned for its simple and low tax regime, making it one of the most business-friendly jurisdictions in the world. The tax structure of Hong Kong is relatively straightforward compared with some of the more complex systems used in other countries in the world. There are two main revenue legislations in Hong Kong:

- the Inland Revenue Ordinance; and

- the Stamp Duty Ordinance.

The Ordinance is administered by the Commissioner of Inland Revenue. There are three distinct and separate headings under this Ordinance: Profits Tax; Salaries Tax and Property Tax.

Hong Kong has simple taxation system in terms of types of taxes and administrative procedures

- NO capital gains tax

- NO dividend tax

- NO estate duties

- NO sales taxes and VAT

- NO annual net worth taxes and no accumulated earnings taxes on companies which retain earnings rather than distribute them

- NO tax on bank interest income

- For corporate, only one tax Profits Tax

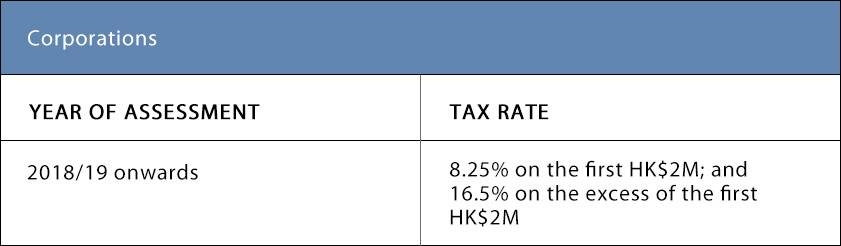

Two-tiered profits tax rates regime: 8.25% on the first HK$2M, 16.5% on the excess of the first HK$2M. - Territorial Principle, possibility of ZERO tax proper tax planning

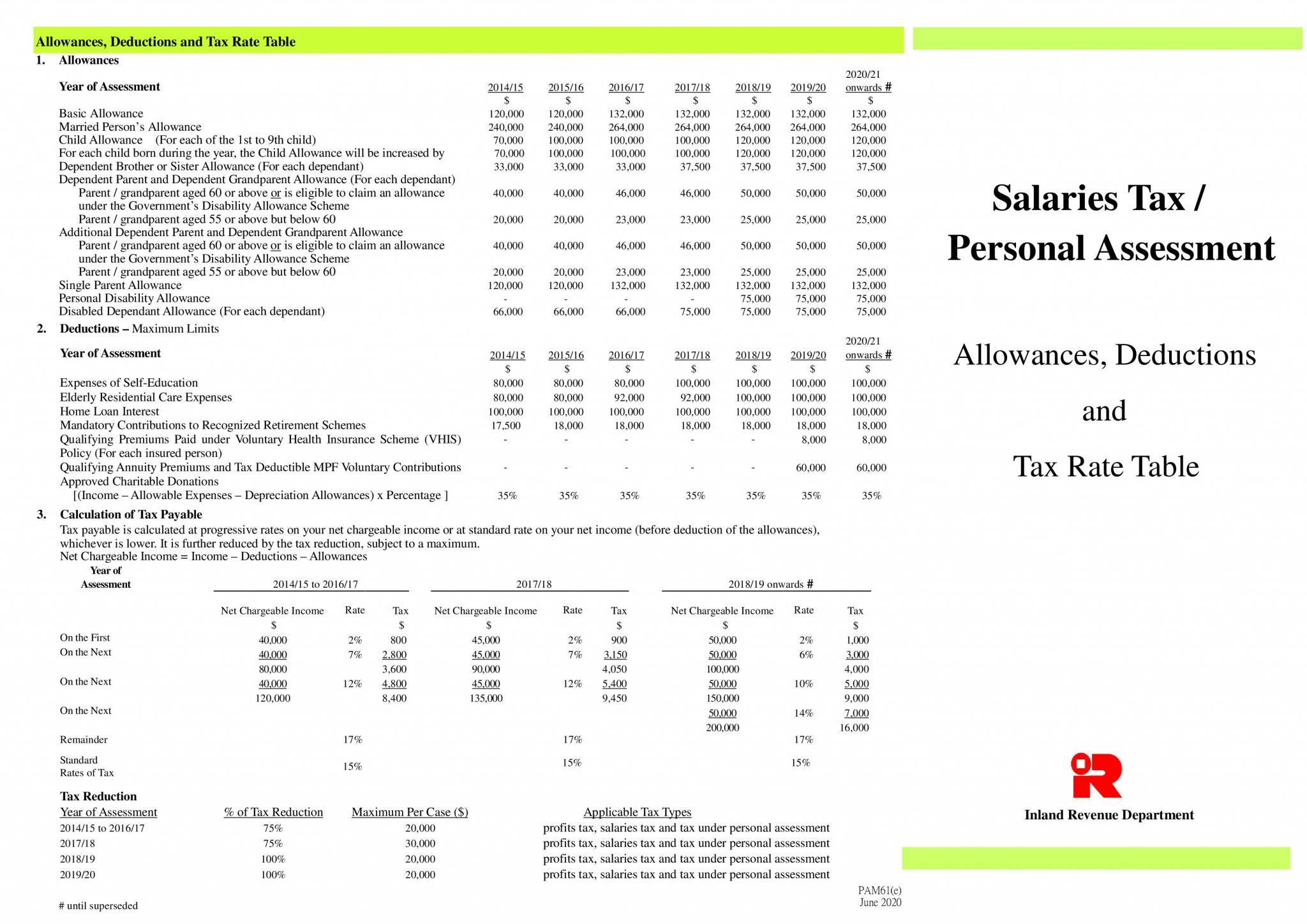

TAX RATES, ALLOWANCES AND DEDUCTIONS:

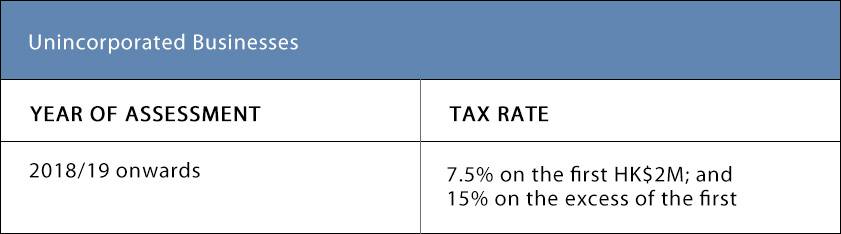

Profits Tax

Salaries Tax

Download

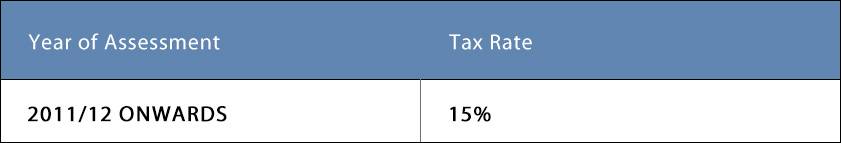

Property Tax

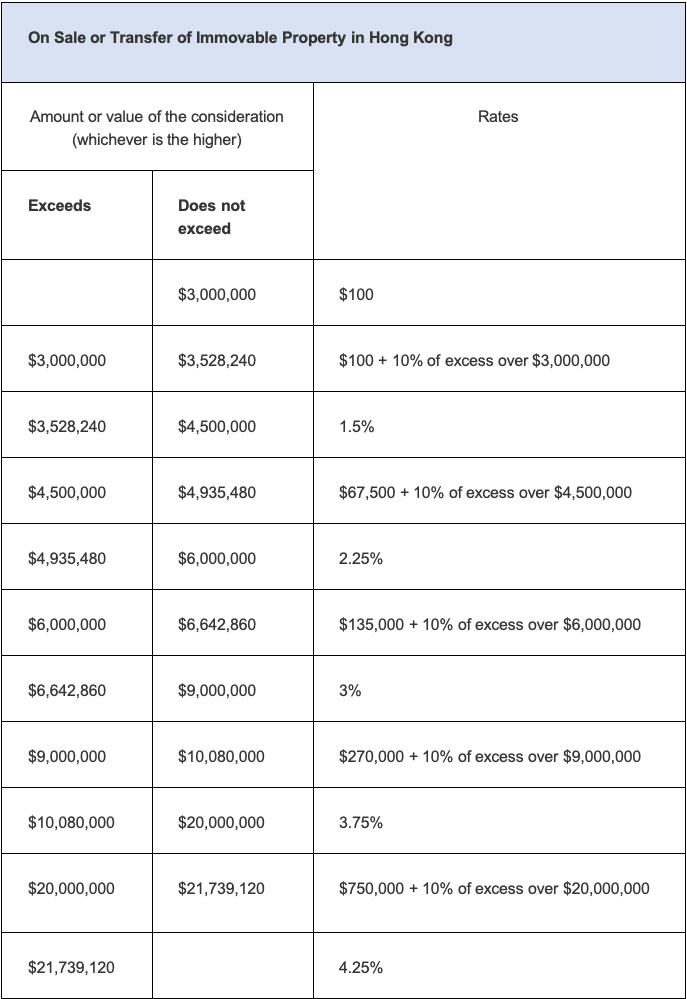

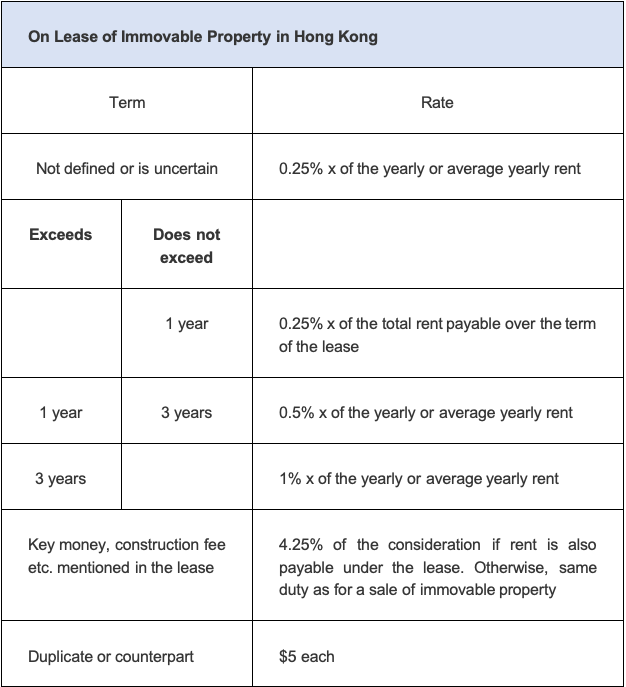

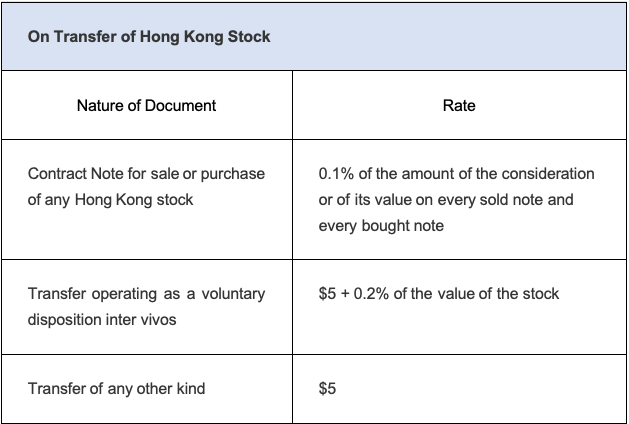

Stamp Duty